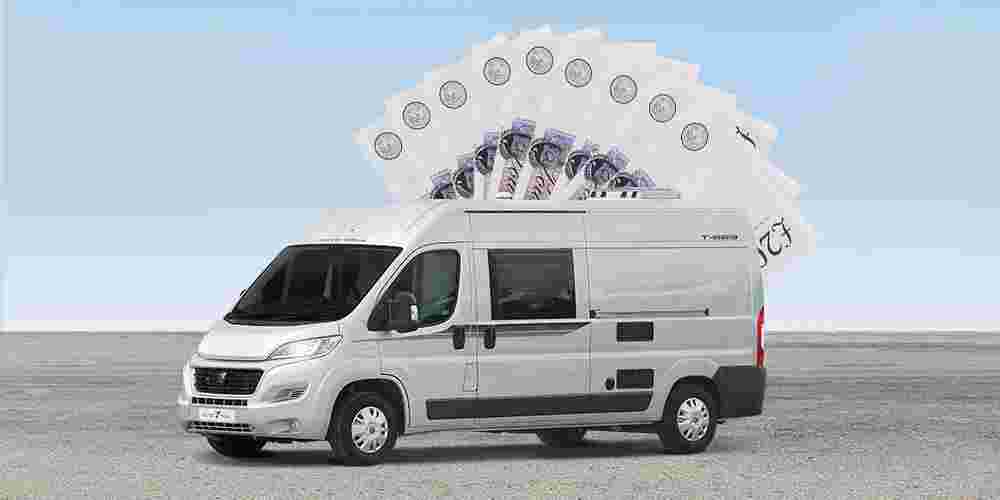

Beat the motorhome tax hike

23.07.19

Beat the motorhome tax hike

Buy before the 1st of September if you want to avoid a 705% rise in your vehicle road tax.

European Parliament has introduced new regulations to the leisure industry - 'The Worldwide Harmonised Light Vehicle Test Procedure (WLTP) which is set to be introduced Europe wide on the 1st September 2019. This in turn has resulted in new vehicle emission tests being based on 'real driving data' which better matches’ on-the-road performance.

From the 1st of September 2019 all road vehicles including motorhomes will have to show a published Co2 output figure on the type approval certificate.

HM Treasury has now included motorhomes for the purposes of applying VED within the passenger car taxation banding.

Any motorhome manufacturers who are building on a Euro 6D/2 base vehicle chassis much specify the WLTP Co2 values on the type approval certificate to allow to tax accordingly.

Motorhomes with the new Euro 6D/2 specification engine will already pay at least £2,000 over and above a Euro 6B/1 spec motorhome. In addition, all Euro 6D/2 based motorhomes will have a Co2 level that exceed the higher taxation band for the first registration.

The new VED is likely to be £2,125, plus if the motorhome is worth over £40,000 there an additional tax of £320.

Facts sourced from NCC official documentation and information supplied by manufacturers.